riverside county sales tax 2020

The Riverside sales tax rate is. The current 20212022 taxes which are due by December 10 2021 and April 10 2022 are included in the minimum bid.

Black Friday Deals At Raceway Ford Riverside Ca 2020 Ford Explorer Ford Explorer Ford

1788 rows California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated.

. 908681 2019 29605 Solana Way Temecula CA 92591. Did South Dakota v. The December 2020 total local sales tax rate was also 7750.

A county-wide sales tax rate of 025 is applicable to localities in Riverside County in addition to the 6 California sales tax. The amount of this tax is calculated at the rate of 055 for each 50000 or fractional part thereof. For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage.

The minimum combined 2022 sales tax rate for Riverside California is. 40140 Village Road Temecula CA 92591. 2021 Riverside County Tax Sale Auction List.

The California sales tax rate is currently. City Rate County. Riverside County residents already pay a half-cent-on-the-dollar sales tax to finance freeway widening and other big transportation projects.

It was approved. The offices of the Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board have. This is the total of state county and city sales tax rates.

They are projec ted at 160 million for FY 202021. Riverside County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Riverside County totaling 025. The County sales tax rate is.

A yes vote supported authorizing the city to levy an additional 1 sales tax thereby increasing the total sales tax rate in the city from 775 to 875 and generating an estimated 1144 million per year in general fund revenue. Secured - The purpose of a Secured tax sale is to return tax defaulted property back to the tax roll collect unpaid taxes and convey title to the purchaser. Top Property Taxes Temecula.

A sales tax measure was on the ballot for Blythe voters in Riverside County California on May 5 2020. California City and County Sales and Use Tax Rates. The Riverside County California sales tax is 775 consisting of 600 California state sales tax and 175 Riverside County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund.

Properties become subject to the County Tax Collectors power to sell because of a default in the payment of property taxes for five or more years. And they are proposing an additional half-cent sales tax that Michael Blomquist toll program director said would raise 88 billion in. The current total local sales tax rate in Riverside County CA is 7750.

The Riverside County Sales Tax is 025. A California documentary transfer tax will be added to and collected with the purchase price. In california its common for both a county and city to impose transfer taxes on real estate sales.

The riverside county sales tax is collected by the merchant on all qualifying sales made. April 30 2020 may 5 2020 be sure that you read all of the information shown to make certain that you clearly understand the process your responsibilities and requirements as a prospective purchaser. What is the sales tax rate in Riverside California.

Pay Property Taxes Online View or Print a Tax Bill View Tax Sale Information View Property Information View Property Sales Locate my Assessment Number File an Appeal Change my Mailing Address. 8 2020 Price NA. The Riverside County California sales tax is 775 consisting of 600 California state sales tax and 175 Riverside County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc.

Local General Fund Bradley-Burns Statewide. Of this 8 percent the City of Riverside receives three types of Sales Tax. Riverside county sales tax 2020 Wednesday March 9 2022 Edit.

645816 2019 41754 Margarita Road. A sales tax measure was on the ballot for Blythe voters in Riverside County California on May 5 2020. Complete List of Available Properties for.

Welcome to the Riverside County Property Tax Portal. Treasurer-tax collector i county of riverside treasurer-tax collector procedural information for tax sale dated. This rate includes any state county city and local sales taxes.

Main Sales and Use Tax Motor Vehicle License Fee in Lieu and Public Safety halfcent- Sales Tax. Riverside County collects on average 08 of a propertys assessed fair market value as property tax. The 875 sales tax rate in Riverside consists of 6 California state sales tax 025 Riverside County sales tax 1 Riverside tax and 15 Special tax.

Sales and Use Taxes are based on a current tax rate of 8percent. Riverside County has one of the highest median property taxes in the United States and is ranked 248th of the 3143 counties in order of median property taxes. Sales and Use Taxes are based on three components that are accounted for separately.

Heres how Riverside Countys maximum sales tax rate of 925 compares to other counties. Food And Sales Tax 2020 In California Heather County Of Riverside Ca Cannabis Applications For Permits Now Accepted Crec 650 St Croix St Henderson Nv 89012 5 Beds 7 Baths St Croix Master Bedroom Interior Contemporary House. Enter your details to get the full list of available properties for the Riverside County Tax Deed Sale PLUS our guide to tax deed investing FREE.

CA Sales Tax Rate. The median property tax in Riverside County California is 2618 per year for a home worth the median value of 325300. 2020 rates included for use while preparing your income tax deduction.

Rates Effective 07012020 through 09302020. For tax rates in other cities see California sales taxes by city and county. The December 2020 total local sales tax rate was also 8750.

CA Sales Tax Rate. 075 lower than the maximum sales tax in CA. You can print a 875 sales tax table here.

The current total local sales tax rate in Riverside CA is 8750. Prior to the COVID-19 c risis Measure A sales tax revenues were stable with average annual growth of over 55 in the last dec ade. Some cities and local governments in Riverside County collect additional local sales taxes which can be as high as 3.

The Commissions voter-approved half-c ent sales tax program serves as the main funding sourc e for transportation funding in Riverside County.

Riverside California Ca 92506 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Riverside County Ca Property Tax Search And Records Propertyshark

Orange County Housing Mystery All Time High Prices With Record Low Sales Orange County All About Time County

County Of Riverside Ca Cannabis Applications For Permits Now Accepted Crec

Food And Sales Tax 2020 In California Heather

County Of Riverside Ca Cannabis Applications For Permits Now Accepted Crec

For Partners First 5 Riverside

Pin On The Ford Lineup At Raceway Ford

Meet Your Treasurer Tax Collector

Bubble Watch Riverside County House Payments Up 16 Despite Cheap Mortgages Press Enterprise

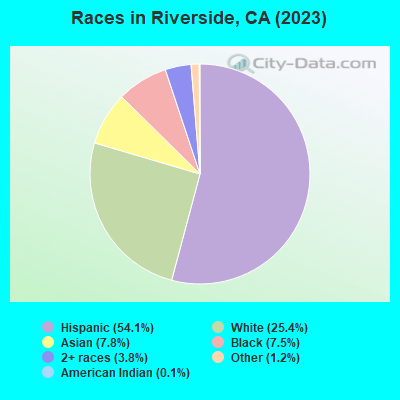

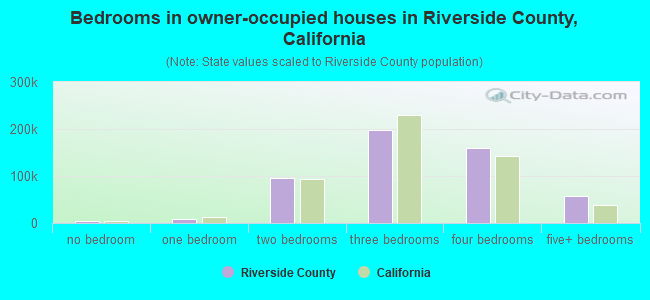

Riverside County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Riverside County Planning Department Home

Planning News Supervisor First District Kevin Jeffries

Riverside County Home Prices Hit 535 000 12th Record High Of Pandemic Era Press Enterprise

5 Takeaways From Riverside County S 6 9 Billion Budget Press Enterprise