gst cash payout 2022

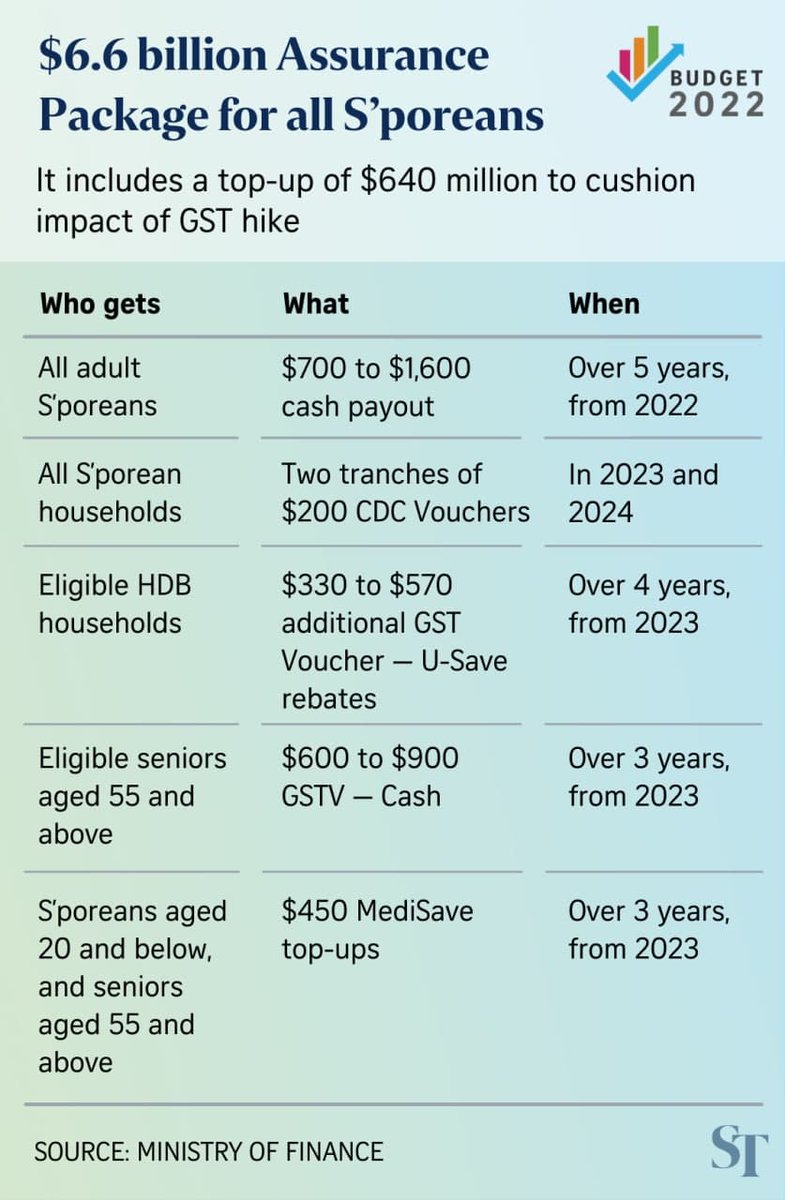

Manage the status of your orders and keep customers well informed. The GST Voucher scheme - comprising a cash payout MediSave top-ups and utilities rebates - will also be enhanced.

Singporeans aged 55 and above.

. Submit Employment Income Records. Transaction Fee Digital Products 10 3. GST HIKE DELAYED TO 2023.

First it will go up from 7 per cent to 8 per cent. CDA EduSave PSEA Top-up. The service and conservancy charges rebate will be made a.

S330 to S570 additional GST Voucher GSTV U-Save rebates. Healthcare subsidies GST voucher that the Government has put in place in recent years to give seniors greater assurance in retirement. All Systematic Equity Plan transactions would attract brokerage equivalent to Cash segment.

It provides a quarterly cash supplement to seniors who had low incomes during their working years and now have less in retirement. Late Filing and Payment Matters. S700 to S1600 cash payout.

The GST collection recorded to be second highest post the GST. Here are nine key takeaways from Budget 2022. According to the draft scheme the first pay-out for retail depositors above Rs 5 lakh will start from year one faster than the second year pay out as per the draft.

Singaporeans aged 0 to 20 in 2021. They will be implemented together before the GST rate increases so that Singaporeans can benefit from both schemes at the same time. View PIC Cash Payout Application Status.

Taking twice of the second cash payout would be equivalent to 1-month contracted gross rent as indicated in the stamped lease agreement for the period 22 Jul 2021 to 18 Aug 2021. The third cash payout will be distributed automatically to all recipients of the second cash payout to ensure that eligible tenants and owner-occupiers receive their payout as quickly as possible. Two tranches of S200 Community Development Council CDC Vouchers.

The 2020 GST Voucher you will receive your GST Voucher Cash Special Payment between June and July 2021 and GST Voucher Cash between July and August 2021 depending on your payment mode. The minimum brokerage for transactions up to 2727 is 15 or 075 whichever is lower. The Central Board of Indirect Taxes and Customs CBIC has notified that 18 Goods and Services Tax GST rate will be applicable 1 J 1 January 2022 onwards and f the 12 GST rate for government contracts will be withdrawn.

OTP Verification Digital Products Detect and avoid. When Is The Payout. It is the sixth tranche of the payment in the current fiscal year meant to help lower- and middle-income families during the Covid-19 pandemic.

Brokerage rate mentioned above would be levied for trade value exceeding 2727 Goods and Services Tax. A fee is levied on each successful transaction on your store. Large value depositors of the erstwhile Punjab and Maharashtra Co-operative Bank PMC can expect a faster payout according to the final notification of the banks restructuring plan by the government.

Four years from 2023. May mid-Sep 2021. Customer can checkout using cash on delivery.

The GST hike will be delayed to next year and implemented in two phases. U-Save Special Payment 120 to 200. All statuary charges would be levied over and above minimum brokerage.

In terms of dividend the stock pays a very respectable 292 dividend yield which works out to be a 010 monthly dividend. In its GST F5 for the accounting period ended 31 Dec 2019 Company A has omitted a standard-rated supply 10000 GST 700 and a taxable purchase 1000 GST 70. Extra S640 million to cushion impact Bookmark Bookmark Share.

GST will go up to 8 next year then 9 from 2024. S600 to S900 GST Voucher. Cash payout MediSave top-up and utilities rebates.

HDB households with at least 1 Singaporean. Disbursed in 2023 and 2024. The Silver Support SS Scheme is part of a wider suite of schemes eg.

Download Donation Application. Apply for GST Registration. Total Value of Supplies 100000.

Submit Income Records for Self-Employed. Five years from 2022. The payment dates can be found in the table below.

The GST Council chaired by Finance Minister Nirmala Sitharaman will meet on December 31 and discuss among other things report of the panel of state ministers on rate rationalisation. Some 950000 households in Housing Board flats will receive their quarterly Goods and Services Tax GST Voucher - U-Save rebates this month. CBIC to withdraw 12 GST rate 1 January 2022 onwards.

The companys payout ratio is a very respectable 81 in terms of earnings and its payout ratio in terms of free cash flows is only around 17. - Goods and service tax GST rate will increase from 7 to 9 per cent in two stages - one percentage point each time on Jan 1 2023 and Jan 1 2024. Singaporeans aged 21 and above in 2021 with annual income up to 28000.

Eligible households should have received three tranches of the quarterly. If you are eligible and have signed up for a previous Government payout eg. These changes will be permanent said Wong.

Salary Slip Template 5 Payroll Template Resume Template Free Quotation Format

Gst Voucher Budget Announcements

Gst Payment Dates 2022 Updated Gst Hst Tax Credit Explained

How Do You Check How Much Government Payouts You Will Be Getting In 2020 Seedly

Budget 2022 S Poreans Aged 21 And Above To Get S 700 To S 1 600 Cash Payout Over Next 5 Years News Wwc

Payment Voucher Format For B5 Paper Voucher Template Free Voucher Invoice Sample

Heng Swee Keat An Overview Of The Measures Announced To Support Families In Terms Of Pre School Services Financial Assistance For Education Helping With Cost Of Living And A Gst Assurance Package

Invoice Form Invoice Template Word Invoice Template Microsoft Word Invoice Template